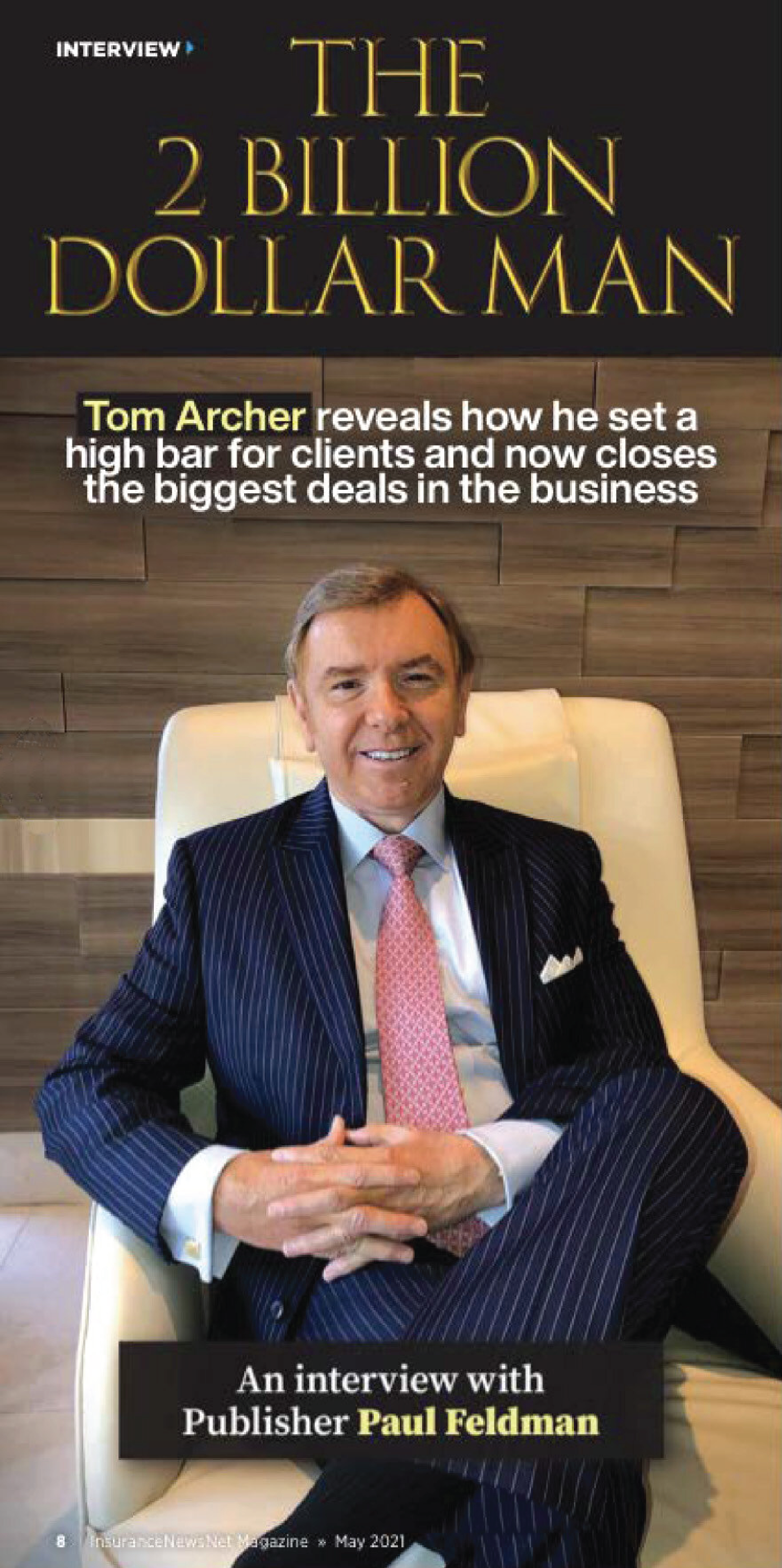

ARCHER FINANCIAL

Wealth Planning

THOMAS J. ARCHER CFP®

For more than 37 years, Tom Archer has served as a trusted financial advisor to the nation's most affluent families. His esteemed clientele consists of numerous Fortune 500 families, including an impressive roster of over 30 billionaires, as well as renowned celebrities and entertainers. Additionally, Tom expertly manages the financial lives of over 200 professional athletes, diligently focusing on wealth accumulation, preservation, and asset protection.

Born in the South Bronx, not far from the iconic Yankee Stadium, Tom's journey began with his education at Our Lady of Perpetual Help Grammar School and St. John the Baptist High School. There, he demonstrated exceptional talent, earning All-League honors in baseball. Throughout his youth, Tom also pursued boxing and later ventured into the world of mixed martial arts, achieving a distinguished black belt. While Tom received numerous baseball scholarship offers, he ultimately chose to attend Mercy University, where he captained the Mercy Flyers during his senior year.

Following his collegiate endeavors, Tom encountered an opportunity to pursue a professional baseball career. Unfortunately, a leg injury sidelined him, but he humbly acknowledges that his abilities fell short of reaching the major leagues. Nevertheless, he graduated Magna Cum Laude, earning his business degree with honors, with a focus on finance. Tom then pursued further professional development, obtaining his certified financial planning designation from the esteemed College for Financial Planning in Denver, Colorado. Embodying a lifelong commitment to learning, he remains a firm advocate of higher education and consistently expands his knowledge by enrolling in current business classes at The Wharton School.

Beyond his financial acumen, Tom harbors an ardent passion for baseball, as evidenced by his ownership of a minor league team. He also serves as the CFO of Baseball Miracles, a noble nonprofit organization that empowers underprivileged children by providing them with instruction and equipment to play baseball—an endeavor close to Tom's heart. Both of Tom's sons, Thomas Jr. and Matthew, played professional baseball before joining Archer Financial.

Throughout his remarkable career, Tom has held prominent leadership positions within several prominent life insurance companies, consistently surpassing production expectations. Notably he is renowned for orchestrating one of the largest life insurance policies ever written—an astounding sum of approximately $300 million dollars. Tom's expertise extends beyond his client interactions, as he is a highly sought-after speaker, delivering captivating lectures on topics such as motivation, entrepreneurial success, and winning in life.

Born in the South Bronx, not far from the iconic Yankee Stadium, Tom's journey began with his education at Our Lady of Perpetual Help Grammar School and St. John the Baptist High School. There, he demonstrated exceptional talent, earning All-League honors in baseball. Throughout his youth, Tom also pursued boxing and later ventured into the world of mixed martial arts, achieving a distinguished black belt. While Tom received numerous baseball scholarship offers, he ultimately chose to attend Mercy University, where he captained the Mercy Flyers during his senior year.

Following his collegiate endeavors, Tom encountered an opportunity to pursue a professional baseball career. Unfortunately, a leg injury sidelined him, but he humbly acknowledges that his abilities fell short of reaching the major leagues. Nevertheless, he graduated Magna Cum Laude, earning his business degree with honors, with a focus on finance. Tom then pursued further professional development, obtaining his certified financial planning designation from the esteemed College for Financial Planning in Denver, Colorado. Embodying a lifelong commitment to learning, he remains a firm advocate of higher education and consistently expands his knowledge by enrolling in current business classes at The Wharton School.

Beyond his financial acumen, Tom harbors an ardent passion for baseball, as evidenced by his ownership of a minor league team. He also serves as the CFO of Baseball Miracles, a noble nonprofit organization that empowers underprivileged children by providing them with instruction and equipment to play baseball—an endeavor close to Tom's heart. Both of Tom's sons, Thomas Jr. and Matthew, played professional baseball before joining Archer Financial.

Throughout his remarkable career, Tom has held prominent leadership positions within several prominent life insurance companies, consistently surpassing production expectations. Notably he is renowned for orchestrating one of the largest life insurance policies ever written—an astounding sum of approximately $300 million dollars. Tom's expertise extends beyond his client interactions, as he is a highly sought-after speaker, delivering captivating lectures on topics such as motivation, entrepreneurial success, and winning in life.

EXECUTIVE TEAM

ARCHER FINANCIAL

Who We Serve

At Archer Financial, we facilitate the planning for some of the world’s wealthiest families. Our esteemed clientele consists of numerous billionaires as well as famous celebrities, Fortune 500 families and over 200 professional athletes from the MLB, NBA, NFL, and NHL. With a relentless commitment to excellence, we tailor bespoke financial structures utilized by such families as the Rockefeller’s and the Forbes’s to name a few. Through our deep understanding of the unique needs of the mega affluent, we redefine wealth planning by setting a new standard of distinction for our clients. We utilize an entrepreneurial spirit and vision to implement solutions, take advantage of opportunities, and optimize results, helping our clients move forward confidently and successfully into the future. With over 37 years of refined experience, our generational wealth structures and tax advantaged life insurance strategies transcend traditional approaches and have withstood the test of time. We secure our clients’ wealth across multiple lifetimes, guaranteeing its enduring impact and sustainability. Our unwavering dedication is rooted in lasting prosperity to sculpt legacies that endure for generations to come.

ARCHER FINANCIAL

WHAT WE DO

WEALTH PLANNING SOLUTIONS TAILORED TO YOUR GOALS

INSURANCE

PLANNING

PLANNING

- Evaluate your current insurance policies from a cost and coverage perspective.

- Tailor the most effective type of Life Insurance coverage for your specific situation.

- Analyze the pros and cons of each different life insurance product available.

- Access to proprietary products.

ESTATE, GIFT AND TRUST PLANNING

- Work closely with attorneys to develop your estate plan.

- Help to eliminate the estate tax burden for our clients and their heirs.

- Estimate estate taxes under current estate plans and devise alternatives with quantifiable tax savings.

- Identify potential liquidity problems at death caused by estate taxes and generation-skipping transfer taxes.

PRESERVING AND TRANSFERRING WEALTH

- Craft tax-effective gifting programs using family limited partnerships, charitable trusts, generation-skipping trusts, and other effective mechanisms.

- Analyze and update your estate plan to capitalize on tax advantages and assure that your beneficiaries not the government, retain the largest possible share of assets.

- Provide for sufficient liquidity for heirs to pay estate taxes.

PROFESSIONAL ATHLETE MANAGEMENT

- Create Wealth Accumulation.

- Insure Wealth Preservation.

- Structure Asset Protection.

- Execute sophisticated disability income plans.

PREMIUM FINANCING

- Analyze the pros and cons of premium financing.

- Discuss various types of collateral options.

- Show several lender options, including fixed and variable loan rates.

- Show all insurance product options.

ANNUITY SAFE MONEY STRATEGIES

- Guaranteed Principal

- Guaranteed Income

- Tax Deferral

- Fixed Rate

- Index Tracking

- Proprietary Product Access

PENSION PLANNING

- Defined Benefit Plans

- Defined Contribution Plans

- 401K Plans

EXECUTIVE FRINGE BENEFITS

- Split Dollar Life Insurance

- Deferred Compensation Plans

- Executive Bonus Plans

HEALTH CARE BENEFITS

- Group Medical Insurance

- Disability Insurance

- Long-Term Care Insurance

- PEO

PROPERTY AND CASUALTY INSURANCE

- Real Estate

- Construction

- Aviation

- Marine

- Environmental

ARCHER FINANCIAL

Testimonials

“The Archer Financial Group’s approach is clear, straightforward and time sensitive. It’s a great feeling to know I have Tom and his group looking after my family’s well-being.”

— JOHN FRANCO

Major League Pitcher, New York Mets

“I couldn’t have been more pleased and amazed with the service provided by Tom Archer. What a fantastic and refreshing approach towards planning for the future. I would highly recommend Tom Archer to anyone seeking advice on life insurance and estate planning.”

— RAY NEGRON

New York Yankees, Special Advisor

“The Archer Financial Group is by far the leading insurance and estate planning firm in the country. I would not put my trust in any other firm but them.”

— ALLEN WATSON

Major League Pitcher, New York Yankees

“I have found The Archer Financial Group to be extremely proactive with regard to my insurance planning. They simply get things done.”

— TIM TEUFEL

Third Base Coach, Major League Infielder, New York Mets

“I am blown away by the work product that The Archer Financial Group produces. They are simply top shelf.”

— JEFFREY INNIS

Major League Pitcher, New York Mets

“It’s nice to have your expectations not only met but exceeded! Tom Archer provided me with professional, friendly & effective service. With Tom, you get a high caliber professional who takes care of his clients.”

— BARRY LYONS

Catcher, New York Mets

“Tom’s business knowledge as well as his baseball knowledge is second to none. He understands how people and players think.”

— SCOTT COOLBAUGH

Hitting Coach, Baltimore Orioles

“I found the professionals at The Archer Financial Group to be uniquely qualified. The knowledge, perspective and practical experience which they brought to the planning process proved to be indispensable.”

— FRANK CATALANOTTO

Major League Baseball Player

“I have worked with Tom for many years. He does a great job for our family and has always looked out for our best interest. He is one of the most talented insurance professionals in his field. I can’t say enough great things about Tom. ”

— ROBERT MANOCHERIAN

Manocherian Brothers

“The service I receive from The Archer Financial Group is among the best I have experienced both in quality, promptness and attitude. This is definitely a client centered company and I am glad to be associated with them.”

— ALLAN ARKER

Principal, The Arker Companies

“Tom is professional, sincere, and has helped us grow our business. We were a fledgling company in 1988, but Tom understood that, and insured us for what we could buy. As our needs have grown, so has Tom’s participation. All partners have personal insurance with him as well – well in excess of $100 million.”

— RANDY GREENBERG

Owner, Crystal Art Gallery

“Tommy Archer thinks big. He is one of the most intelligent and talented insurance professionals that I have ever dealt with. The products and services he offers has led to a tremendous tax savings for my business and my family. I now feel protected and I highly recommend him.”

— STEWART RAHR

Owner, Kinray Inc.

“The Archer Financial Group’s creative estate and business planning techniques will assist with tax savings for my family.”

— JACK SCHACHTER

Owner, Kleinfeld Wedding Dresses

“I found Tom and The Archer Financial Group to be extremely knowledgeable and helpful. Tom is very thorough and improved our planning situation immensely. We have a tremendous amount of trust and confidence in Tom and his organization.”

— JOE GIRARDI

Former Major League Catcher and Current Manager of the Philadelphia Phillies.

“I have known Tom since I recruited him out of high school. He was a tremendous player and super intense. I knew he would go on to be the best at whatever he did.”

— BOB HIRSCHFIELD

Legendary NYIT Baseball Coach and Owner of N.Y. Baseball Academy

“Tom Archer and The Archer Financial Group staff are the best in business. I will always trust Tom for all of my personal and family insurance needs.”

— CARSON FULMER

Major League Pitcher, Los Angeles Angels

“I found Tom Archer to be extremely knowledgeable with regard to my family’s life insurance and estate planning. I trust Tom implicitly and hold him in very high esteem.”

— ED BLANKMEYER

Head Baseball Coach St. Johns University

“Most people are either book smart or street smart, Tom possesses both of these traits which is why he is the top insurance advisor in the country.”

— TERRY BROSS

Major League Pitcher, New York Mets

“The Archer Financial Group helped avert a potentially difficult business situation which would have proven uncomfortable for all of the interested parties. They helped to create harmony by identifying and resolving the needs of each partner and the members of his family. We can now proceed into the future with a unified plan.”

— PAUL GENOVESE

Owner, Genovese Drug Store Chains

“With all of the financial and life products available, from so many different companies and agents; Tom Archer is able to recommend, analyze and evaluate the differences and find the most suitable program for helping to achieve our goals. The Archer Financial Group makes the whole process run smoothly, and efficiently without any complications. It has been a pleasure working with The Archer Financial Group and I happily recommend family and friends to Tom Archer, for the quality of service and financial guidance that he has given me.”

— ALBERT KALIMIAN

Real Estate Investor

“The Archer Financial Group coordinated the efforts of my other advisors in a way that made everyone’s participation easier and more effective. The decisions I had avoided for so long were suddenly not difficult at all.”

— HYMIE GOLDEN

Owner, Snapple Iced Tea

“I have known Tom for over forty years. We were teammates and won several championships together. He is very intense, talented and was a hard nose player. I coached both of his sons after my retirement from major league baseball. Both of his sons are super talented and very disciplined and hardworking. They are the hardest working family I know in baseball and in business. I put all my trust in Tom and his organization.”

— JOHN HABYAN

Former Major League Pitcher & Current Pitching Coach for the Kansas City Royals Organization

“I’ve been lucky enough to know the Archer’s for a while now. They’ve always held themselves to a high standard and been an incredible example of professionalism. I’m lucky to know people who do such great work in business and in life.”

— LOGAN O’HOPPE

Major League Catcher for the Los Angeles Angels

“I found the Archer Financial Group to be tremendously helpful in my planning process. They are very in tune with the issues that Professional Baseball Players face and they understand how professional athletes think. I trust them implicitly.”

— RICHIE PALACIOS

Professional Baseball Player, Tampa Bay Rays

ARCHER FINANCIAL

Media

MOTIVATION

with Thomas Archer

How does a kid from South Bronx grow up to build one of the most successful financial

service companies in the country and handle mega policies for a foster of wealthy

clients that includes 17 billionaires? Hard work, perseverance and determination.

Play Video

Motivation 1

Play Video

Motivation 2

Play Video

Discipline – Mental Toughness – Self Confidence

Play Video

Tommy Archer Interviewed

Play Video

A Day in the Life

AS SEEN IN:

Contact

ARCHER FINANCIAL

Headquartered in Boca Raton, Florida

Florida

100 Plaza Real South

Boca Raton FL, 33432

Boca Raton FL, 33432

561-774-8986

New York

445 Park Avenue

New York, NY 10022

New York, NY 10022

212-330-9903

California

9454 Wilshire Blvd

Beverly Hills, CA 90212

Beverly Hills, CA 90212

310-473-3921

Long Island

225 Wireless Blvd

Hauppauge, NY 11788

Hauppauge, NY 11788

631-416-5400